Over the last weekend, I happened to read not just one or two, but three different pieces concerning the unicorn startups who are seem to be on an endless spree to throw investors’ money. What I read got me wondering if we are seeing the first signs of cracks into this model. The purpose of this post is to put these things together, so that startups planning to go this way have some input to ponder on.

Background

Many years ago, an online retailer made headlines by offering 2 kg rice at a a ridiculously cheap price. After all these years, I do not remember the exact details and I may be wrong even about whether it was 2 kg rice or soemthing else. (If someone remembers, please mention it in a comment.) What I remember, however, is that it was way below the market price, and that left many wondering why any business would do such a thing.

Since then, we witnessed many other such offers. At times, there were smart phones and at other times it was something else. A car ride booked online used to cost less than an autorickshaw ride (note: autorickshaw has lower maintenance cost and fuel efficiency than a car). Consumers enjoy the bonanza.

Since it happened again and again, there must be some sense to it. Clearly, the companies are not making profits at those throwaway prices. Since they are not manufacturing those goods / providing those services, which have some definitive cost, so these companies must be incurring losses in that process.

The glamour of the multi-million dollar evaluations of these startup unicorns and spectacular funding stories was enough to silence any doubts. This became the new way of making a successful startup, and startup founders started working on business models to become the next unicorn.

However, all is not well. Lately some voices have started raising concerns about these stories. It would be a mistake to ignore them.

So, What Are the Concerns?

Your Motives are Suspected

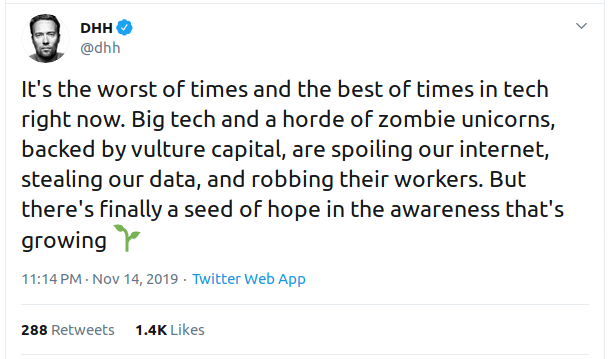

You are throwing money in exchange for our data. What are you going to do with that data? Look at the following tweets to see the sentiments of some technocrats:

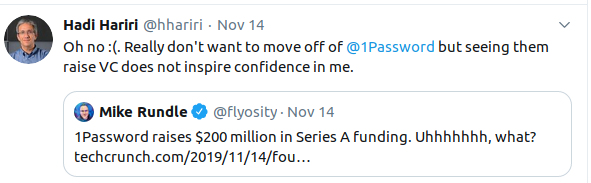

Here is an immediate reaction from a top technocrat as a reaction to a funding news, which is representative of the negative sentiment it generates:

The point is not whether your intentions are malicious. But the negative sentiments are for real.

You Are Seen as Monopolistic

You are bribing customers to choose you and taking business away from small players. These small players would not be able to sustain this competition and close down. This is seen as creating monopoly through unfair means.

Once the small players are wiped off, you may hike the rates to whatever level you want. Some food delivery businesses already seem to be overcharging. Recently, someone checked the price of the food served at the restaurant vs offered online, and was shocked at the difference.

Monopolies are hated by the consumers, your dying competitors, and more importantly, the government. If you are underpricing your offering below the cost, you may get in trouble because of that as a suspected monopolistic practice. Check out this article about a probe being ordered by the Supreme Court.

It is unlawful to sell a product below its cost price in some countries. Beware!

Undesirable Social Impact

Another article The SoftBank Effect: How $100 Billion Left Workers in a Hole talks about how the cash-funded unicorns from a variety of sectors have left their vendors high-and-dry and invited their wrath.

When a funded startup comes under the inevitable pressure from the investor to become profitable, then such an unrest may get created. How would the founder, who started off with an objective to change the world for the better, like to hear about people getting negatively impacted?

Summary

This is not to make a bland statement that funding is inherently bad. It is not. Many businesses need funding to start or to grow.

However, it is about how the funds would get utilized. If you are planning to play a dirty pricing war and kill your competition by pouring loads of cash, then think twice.

[Images by PublicDomainPictures from Pixabay]